What Does Suntec Reit Group Ltd Do

Suntec Real Estate Investment Trust also known as Suntec REIT is a Singapore-listed REIT that manages 813753 sq ft of office and retail space in an integrated commercial development known as Suntec City. Owns 4 of common stock.

Suntec Reit Overview Realvantage Insights

Note that Suntec REIT has no official sponsor it is managed by ARA Trust Management Suntec Limited a wholly-owned subsidiary of ARA Asset Management Limited.

What does suntec reit group ltd do. The above examples show that you need not own any of the indexs components to do well. Mr Chong is a member of the ARA Group Investment Committee which oversees investment strategies. In Singapore its portfolio consists of Suntec City which includes one of the largest convention centers and retail malls in Singapore along with stakes in One Raffles Quay and MBFC Properties.

While I am a unitholder of Suntec REIT at the time of writing this post definitely does not serve as a buy or sell call for the REIT. In terms of ownership ARA Asset Management Limited holds 8 percent of the company. In Australia it owns an office tower in Sydney.

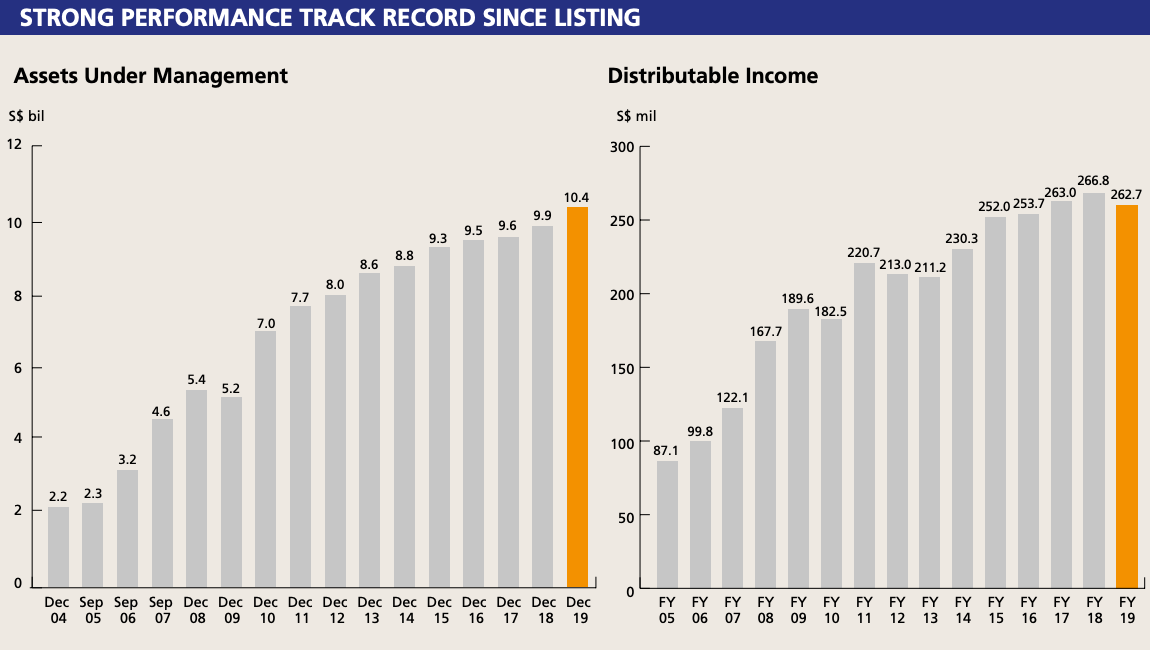

Listed on 9 December 2004 Suntec REIT holds properties in Suntec City Singapores largest integrated commercial development including one of Singapores largest shopping mall a 608 interest in Suntec Singapore Convention Exhibition Centre a one-third interest in One Raffles Quay. There are no hedge funds involved in Suntec Real Estate Investment Trust. Its aim is to invest in income-producing real estate which is primarily used for office andor retail purposes.

REITs such as Parkway Life REIT SGX. Our system integrators have certified resources who design custom solutions based on the award winning Xelerate platform and help deploy and manage the same for our customers. Keppel REIT is one of Asias leading real estate investment trusts REITs listed on the Singapore Exchange with a portfolio of Grade A commercial assets in key business districts pan-Asia.

Please do your own due diligence before you make any investment decisions. Suntec REIT SGX. C2PU Frasers Centrepoint Trust SGX.

Suntec REIT is a commercial REIT that focuses on offices and to a lesser extent retail properties. Park Mall Besides being a home furnishing mall for high end furniture or a less crowded hang out Park Mall seems to be the less popular alternative compared to the almost always jam-packed Plaza. Part of Suntec Real Estate Investment Trust Suntec REIT MTN Pte Ltd.

The answer point to Suntec REITs focus of maintaining a portfolio of commercial properties including retail and office space which Marina Bay Residences do not fall under. Suntec REIT is a key beneficiary with Singapore assets Suntec City One Raffles Quay and MBFC Properties. The Straits Times Singapore February 20 2020 Sheng Siong SIA.

Prior to joining the manager he was previously the CEO of OUE Hospitality REIT. Suntec Real Estate Investment Trust is not owned by hedge funds. Click here to join The Singaporean Investors Telegram group to receive updates whenever a new post is added to the site.

To see a list of our certified system integrator partners click here. About five percent of the shares are held by this company. J69U and Suntec REIT SGX.

He is also a member of the ARA Group Investment Review Committee which oversees ARAs global investment strategy. Despite laying off nearly half of its workforce last week Suntec REITss market cap was able to rise 4 throughout the month of August. ARA Asset Management Limited is the second largest shareholder owning 84 of common stock and BlackRock Inc.

Firstly theres the immediate. T82U are also not part of the STI. Its shares are listed on a stock exchange and can be and traded like a stock.

SunTec works very closely with system integrators who provide value added services to our customers. A REIT is a corporation trust or association that invests directly in income-producing real estate. Within the integrated development the company owns office units in Suntec Towers One Two and Three and the entirety of Suntec Towers Four and Five.

On 28 August 2020 it was reported that a total of 85 personnel out of 178 roles from sales operations finance and. The REIT has assets under management of approximately 9 billion in Singapore key Australian cities of Sydney Melbourne and Perth as well as Seoul South Korea. This may not be an apple to apple comparison as each focuses on a different sector or a different geographical location.

Over 990 leased to the UK Government providing attractive and recession-proof yields Elite Commercial REIT is a Singapore real estate investment trust REIT established with the investment strategy of principally investing directly or indirectly in commercial assets and real estate-related assets in the UK. The gain on divestment amounts to S665 million and the REIT enjoyed a 305 return on the cost of its. But all three REITs reported higher year on year distribution per unit.

Is a company headquartered in Singapore Singapore focused on real estate investment trusts. Suntec REIT also holds a 500 interest in Nova Properties located in London United Kingdom. Mr Chong has 30 years of financial and management experience.

T82U Share price target average. Mr Chong Kee Hiong is CEO of ARA Trust Management Suntec Limited manager of Suntec REIT. REITs are required to pay a minimum of 90 of taxable income in the form of shareholder dividends each year.

Holds about 50 of the company stock. Suntec REIT is managed by an external manager ARA Trust Management Suntec Limited. Estimated upside from last traded price.

Prior to joining the Manager Mr Chong was the Chief Executive Officer of OUE Hospitality REIT Management Pte Ltd from 2013 to 2018. Mr Chong has close to 30 years of financial and management experience. The company is currently owned by Yigang Tang who holds 17 of outstanding shares.

Last week the REIT announced that it was divesting its 30 stake in its 9 Penang Road property for 2955 million. Located at 55 Currie Street Adelaide Australia. Suntec REIT is one of Singapores oldest REITs and holds a portfolio of retail and commercial properties in Singapore Australia and the UK.

Yigang Tang is currently the largest shareholder with 17 of shares outstanding. Suntec REIT SGXT82U 441 Weightage Suntec REITs portfolio consists of retail office and convention centre assets in Singapore Australia and in the United Kingdom. Source of equity When the REIT is raising funds via rights issue the sponsors may support the exercise by undertaking to subscribe for their pro-rata entitlement of rights units and also to subscribe to.

Ltd a wholly-owned subsidiary of its sponsor FN.

Suntec Reit Overview Realvantage Insights